- Quickbooks online simple cashflow forecasting tool manual#

- Quickbooks online simple cashflow forecasting tool software#

- Quickbooks online simple cashflow forecasting tool trial#

- Quickbooks online simple cashflow forecasting tool plus#

Fundbox makes it quick and simple for small businesses to access a line of credit when they need it.

When your business experiences a cash flow crunch a line of credit may be just what you need to keep moving forward.

Quickbooks online simple cashflow forecasting tool trial#

If you’re ready to give TSheets a try, they offer a 14-day free trial at either subscription level. budgeted hour comparisons, and geofencing at $40 per month + $10/mo per user. TSheets has also just introduced their Elite plan, which adds features like timesheet signatures, actual vs.

Quickbooks online simple cashflow forecasting tool plus#

It gives you all the features we just mentioned plus a few more. TSheets Premium is $20 per month + $8/mo per user. When team members enter or leave the job site, the app’s GPS will trigger a reminder to clock in or out of the job. The new geofencing feature lets you set a physical location for each job. Since the schedule is accessible from the mobile app, your team won’t need to access a central location to see when they work. You can easily create a weekly schedule and share it with your team so they know what they’re working on and when. By syncing with QuickBooks Online, you can connect timesheet data directly to the customer you’re working with, and import billable hours for fast, accurate invoices.Įven if you run your business alone, with no employees, TSheets is a great tool for tracking your productivity and recording the hours spent on each project so you can invoice more accurately.Īnother great feature of TSheets is employee scheduling. You can easily track those hours by employee or by job, producing insightful reports. Your team can clock in and out of jobs from anywhere using the mobile app. It helps users track labor and save time and money on their payroll by simplifying the time tracking process. TSheets is a cloud-based time tracking tool. So, how do you know which QuickBooks Online apps you need? Below are five of the most helpful QuickBooks Online apps to unlock the power of QuickBooks Online for your small or medium-sized business.

Quickbooks online simple cashflow forecasting tool manual#

The right app stack can help you save time, cut down on manual entry, and give you deeper insights into your business. No matter what industry you’re in or what you need help with, there’s an app for that.

Quickbooks online simple cashflow forecasting tool software#

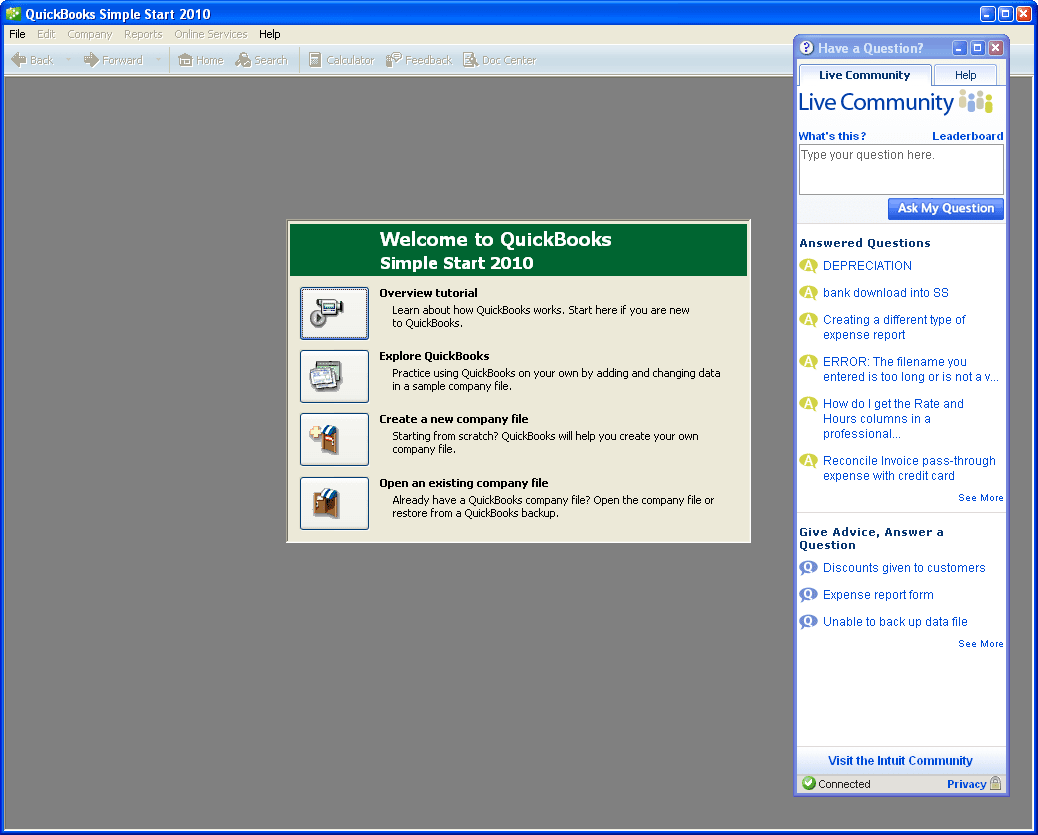

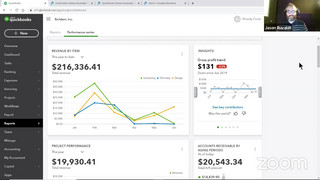

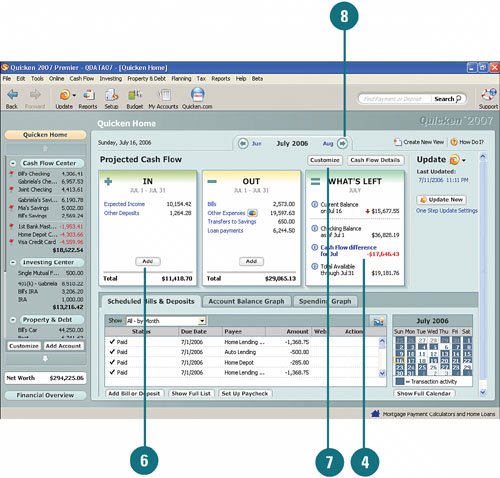

There are over 500 apps available in the QuickBooks Online app store, all of which synchronize with your accounting software to help you run your business. What makes QuickBooks Online even more powerful is its app ecosystem. It’s a powerful tool that allows you to manage your finances on your own from anywhere in the world, or effortlessly collaborate with a bookkeeper or accountant. QuickBooks Online remains the number one accounting software for small businesses. Terms and conditions and fees apply.Unlock the power of QuickBooks Online with QuickBooks Online apps and addons from the QuickBooks app store. *5 Subject to eligibility and Credit Check. £500.00 per cheque limit applies, £2,500.00 limit per day. *4 There is a charge of £0.50 per cheque deposited in-app.

Representative fees and rates: How much you pay for your overdraft depends on your overdraft limit, the amount of your overdrawn balance and how long you are overdrawn for. *3 Subject to eligibility and Credit Check. You don't have to open, have or maintain a HSBC Kinetic Current Account to open, have or maintain a HSBC Kinetic Savings Account and/or HSBC Kinetic Small Business Loan. If you want to open an HSBC Kinetic Savings Account and/or HSBC Kinetic Small Business Loan without opening an HSBC Kinetic Current Account, please call 03 or +44 1397 436960 if you're outside the UK. *2 Subject to eligibility and Credit Check. Subject to eligibility, credit check and terms and conditions. Other fees and charges apply, see pricelist for details. Fees subject to change, customers will be notified in advance. The monthly current account maintenance fee after the fee free period is £6.50 per month. *1 If you apply on or after 1 June 2021 there will be no monthly current account maintenance fee for 12 months from account opening date.

0 kommentar(er)

0 kommentar(er)